The Rise of Forex Trading Bots: Revolutionizing Currency Trading

The foreign exchange market, or forex, has long been a domain of professional traders and investors, but with the advent of technology, a new player has emerged: Forex trading bots. These automated trading systems are transforming the way individuals engage in currency trading. In this article, we will explore what Forex trading bots are, how they work, their advantages and disadvantages, and their future in the trading world. To effectively engage in Forex trading, you need a trusted partner. Check out forex trading bot Trusted Trading Brokers for reliable information.

What is a Forex Trading Bot?

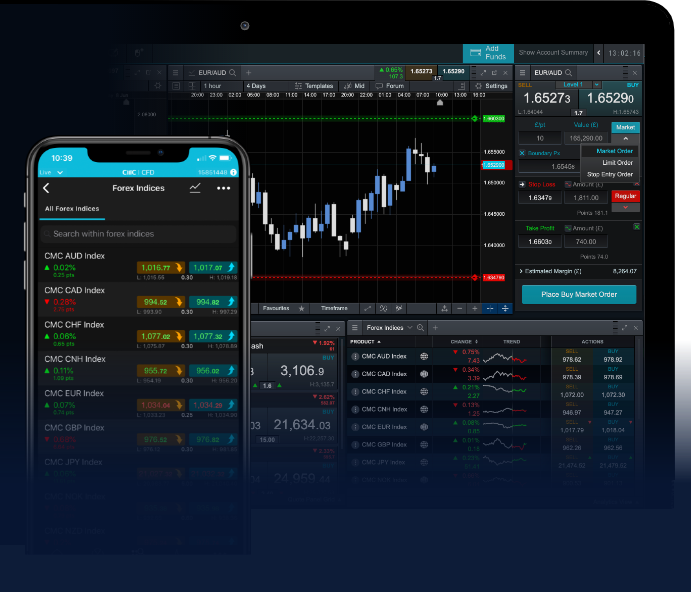

A Forex trading bot is a software program designed to connect to a trading platform and execute trades automatically on behalf of the user. These bots analyze market data, generate trading signals based on predefined criteria, and execute trades accordingly. They can operate 24/7, allowing for transactions even when the trader is not actively monitoring the market. The primary goal of these bots is to increase the efficiency and accuracy of trades while minimizing human errors.

How Do Forex Trading Bots Work?

Forex trading bots utilize algorithms to analyze multiple market variables, such as price movements, trading volumes, and technical indicators. They rely on historical data to make predictions about future market behavior. Here’s a simplified breakdown of how they operate:

- Data Gathering: Bots collect vast amounts of market data, including trends, economic news, and user sentiment.

- Analysis: Utilizing various trading strategies, the bot analyzes the gathered data to determine optimal entry and exit points.

- Execution: When a favorable market condition is identified based on the bot's analysis, it executes trades without any human intervention.

Types of Forex Trading Bots

There are several types of Forex trading bots available, each designed for different trading strategies and philosophies:

- Grid Trading Bots: These bots operate on a grid trading strategy, placing buy and sell orders at intervals. They can capitalize on market fluctuations and volatility.

- Trend Following Bots: As the name suggests, these bots identify and follow prevailing market trends, executing trades in the direction of the trend.

- Arbitrage Bots: These bots capitalize on price discrepancies between different exchanges or markets, buying low in one market and selling high in another.

- Market Making Bots: These bots place both buy and sell orders, creating liquidity in the market and profiting from the bid-ask spread.

Advantages of Using Forex Trading Bots

Forex trading bots offer several advantages that make them appealing to both novice and experienced traders:

- 24/7 Trading: Bots can operate around the clock, ensuring that opportunities are not missed simply because the trader is sleeping or busy.

- Emotionless Trading: Bots operate purely on data and algorithms, removing emotion from trading decisions, which can often lead to impulsive mistakes.

- Backtesting: Many bots allow for backtesting against historical data, enabling traders to assess performance and fine-tune their strategies before live trading.

- Speed and Efficiency: A bot can analyze vast amounts of data and execute trades faster than any human could, allowing for quick responses to market changes.

Disadvantages of Using Forex Trading Bots

While Forex trading bots can be incredibly beneficial, they also come with certain risks and disadvantages:

- Technical Issues: Bots can suffer from technical glitches, connection issues, or bugs in programming that can lead to unintended trades or losses.

- Over-Reliance: Traders may become overly dependent on bots, neglecting to develop their trading skills and understanding of the market.

- Market Changes: Bots are based on historical data and may not adapt well to sudden market changes or events outside of their programmed parameters.

Choosing the Right Forex Trading Bot

Selecting an appropriate Forex trading bot is crucial for success. Here are some tips to help you choose wisely:

- Research: Look for reviews and testimonials from other traders to gauge the effectiveness of the bot.

- Performance Metrics: Consider bots that provide access to performance metrics and history to evaluate past results.

- Customization: Ensure that the bot allows for customization so you can tailor its settings according to your trading strategy.

- Support and Updates: Choose a bot from a provider that offers robust customer support and regular updates to keep up with market changes.

The Future of Forex Trading Bots

The future of Forex trading bots appears promising as technological advancements continue to shape the finance industry. With the rise of artificial intelligence and machine learning, we can expect bots to become even more sophisticated, capable of making better predictions and improving trading strategies. However, it’s essential for traders to remain well-informed and not solely rely on automation.

Conclusion

In conclusion, Forex trading bots have revolutionized the currency trading landscape, offering numerous benefits while also presenting certain risks. As the trading environment evolves, these automated systems will likely play an increasingly vital role. It's crucial for traders to stay informed, choose reliable bots, and ensure that they understand the market dynamics to maximize the benefits of Forex trading automation.