Specific provide educational content, on the internet training and in-individual seminars. Additional features to adopt with trading and investing applications are the top quality and you can way to obtain screening and you may inventory study devices, on-the-wade notice, effortless purchase entryway and customer service. Day trading form to play sexy potato with brings — selling and buying a similar stock in one single change time. They try to make a few bucks in the next few moments, times or months centered on every day price shifts.

Getaways & Trading Times

Which is, unlike possibilities that will eliminate each of their value more a primary day, stocks often hold a lot of their really worth. Very stocks strike a sweet put – sufficient way as winning so you can trading, however a great deal to end up being utterly ruinous. Investing the stock exchange is amongst the best means to build the newest wealth you ought to arrived at requirements such to buy a house, investing in a kid’s education or retiring. Matt DiLallo might have been a contributing Motley Deceive stock exchange specialist devoted to layer dividend-investing enterprises, particularly in the energy and you will REIT circles, because the 2012. If you are stocks can also be best and you can crash out of the blue, they generally disperse large.

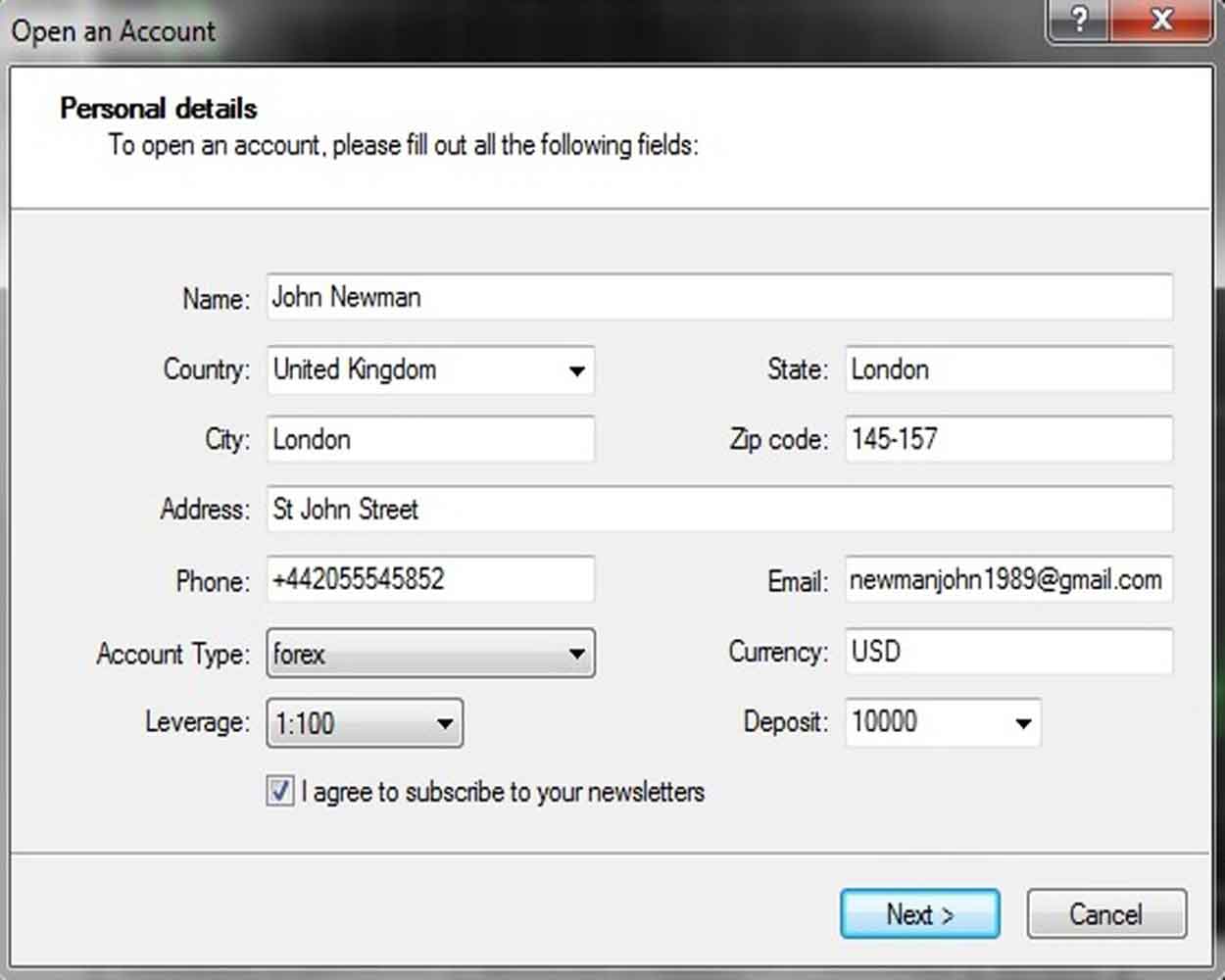

TD-Ameritrade brings an example membership having complete access to the brand new ThinkOrSwim system to allow you to test out it without risk. An online trading balance out of $a hundred,100000 exists to train change which have free availableness to have 60 weeks. In contrast, people have a tendency to hold on to its assets up to old age, selling and buying infrequently rather than to buy and promoting during the durations. Less than you’ll discover our come across to discover the best payment-100 percent free brokers that are highly reputable and you can designed for beginners.

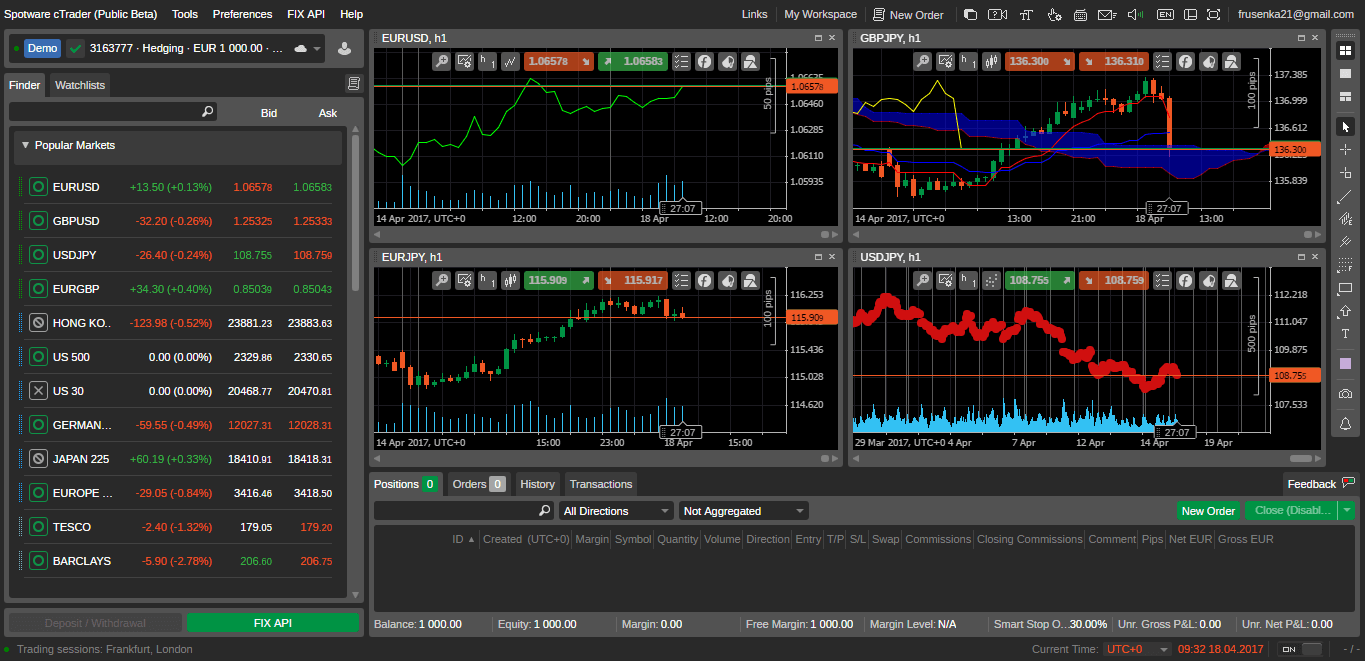

Technology investigation comes to studying a security's speed and you may frequency background so you can get to know what it does second and you may identify the best times to get in and you may log off a posture. Because of the studying a security's rate history, you might identify way manner. Feedback shown try at the time of the fresh go out shown, according to the information offered at that point, and may changes centered on field and other requirements. Except if or even indexed, the fresh feedback provided are those of your speaker otherwise author and never that from Fidelity Investments otherwise the associates. Fidelity reserves the legal right to terminate a free account any time for abusive change techniques or other need. An alternative choice is always to believe setting a halt-losings purchase, and this immediately triggers a sale at a price you determine.

You must control your chance if you are ultimately ataraxicsolutions.com working and real money is at stake. This involves pinpointing, determining, and you can ranks dangers to reduce their impact on their profile. You can cover your own difficult-attained investment, restrict losses, and you will alter your trade overall performance because of the implementing active risk administration actions.

Change actually step one, 10, or 20 offers often serve its informative goal. As opposed to to shop for an entire share of a great $3 hundred inventory, you might purchase $dos and you will individual step one/150 from a share. You to definitely higher advantage of trading and investing is based on the truth that the game itself lasts a lifestyle.

For the majority of people, long-identity, diversified investment procedures are still an even more reputable way to economic progress. Instead of long-term investors, day traders is actually shorter worried about might value of the fresh bonds and much more worried about capturing immediate progress away from business activity. Before the dematerialisation away from shares, investors must be in person present in the transfers in which the shares it planned to trade-in was indexed.

2: Figure out how much can you afford to dedicate

Candlestick trading apparently uses chart patterns, rendering it a little more straightforward to come across previous field spaces and you may closes. A bounce trend happens when a cost development suggests a shift inside the development direction. However, a continuation pattern takes place when the pattern continues on in its expose highway immediately after a primary reprieve. Meanwhile, ascending analysis things, including highest swing levels and lower swing downs, characterize uptrends.

Specific render entry to investment lookup and other has that are particularly used in brand new traders. And some has actual department communities, which is sweet if you need face-to-face money information. Many online stockbrokers have removed trade earnings to own on line stock trades. Thus, really (however all the) take a level play ground as far as costs are worried, unless you're change options otherwise cryptocurrencies, both of which in turn has trading costs. In simple terms, the market is no spot for currency you may want in the next 5 years, at a minimum.

He/she can not only reply to your issues however, usually also be able to identify certain portion you should work to the. They might were thanks to similar points that you'll since the a new buyer, and therefore their feel is also make suggestions. You can discover off their mistakes instead of repeating her or him yourself.

Paying isn’t playing, and the cause to pay unlike see a casino is that prudent, diligent, and disciplined spending is when really traders rating to come. That it student’s book explains more procedures to buy brings, if or not you've got plenty arranged otherwise can also be dedicate a more small $twenty five per week. Subscribe our Exchange Approach Desk instructors to assist build your degree on the technology analysis, options, Productive Investor Pro, and much more. To the Information area, Wall surface Road Survivor sifts due to each one of these businesses to carry your a carries to buy. Habit strengthening a virtual collection of carries, ETFs, alternatives & cryptos. For many who’lso are staying away from a taxation-advantaged membership — for example a 401(k), otherwise a great Roth otherwise conventional IRA — taxation for the growth and you can losses could possibly get complicated.

The brand new Funded Trader Comment: Is the Funded Trade System Worthwhile?

Volatile business shifts is trigger big margin calls for the brief see. People who you will need to go out change as opposed to understanding field principles have a tendency to lose cash. A working knowledge of tech study and you will chart studying is actually a a begin. But instead a deep knowledge of the marketplace and its own book threats, maps might be misleading.

Development events, earnings reports, and other issues may impact the areas and build erratic change criteria. Full, the new PDT code is designed to cover people by restricting their chance publicity and making certain they have enough money to cover possible losses. People need to understand the new PDT signal and its own ramifications ahead of stepping into go out change items. Securities and Exchange Payment (SEC) in order to traders which execute four or more "time trades" within this five business days using a great margin account. An excellent "go out trade" means investing the same defense on the exact same date. Day traders should be conscious of the brand new income tax effects away from their change hobby.

Prior to purchasing the first stock, be sure you has a powerful emergency money—generally three to six days’ worth of expenditures. The stock market try unstable, and you can water savings make sure you’re also perhaps not compelled to offer assets during the an excellent downturn. Variation function dispersed the opportunities across additional property to attenuate chance. A good varied profile range from a mixture of holds from certain marketplaces, ETFs, and possibly bonds otherwise home.